Introduction To and Completing the Reconciliation Process

Lesson progress:

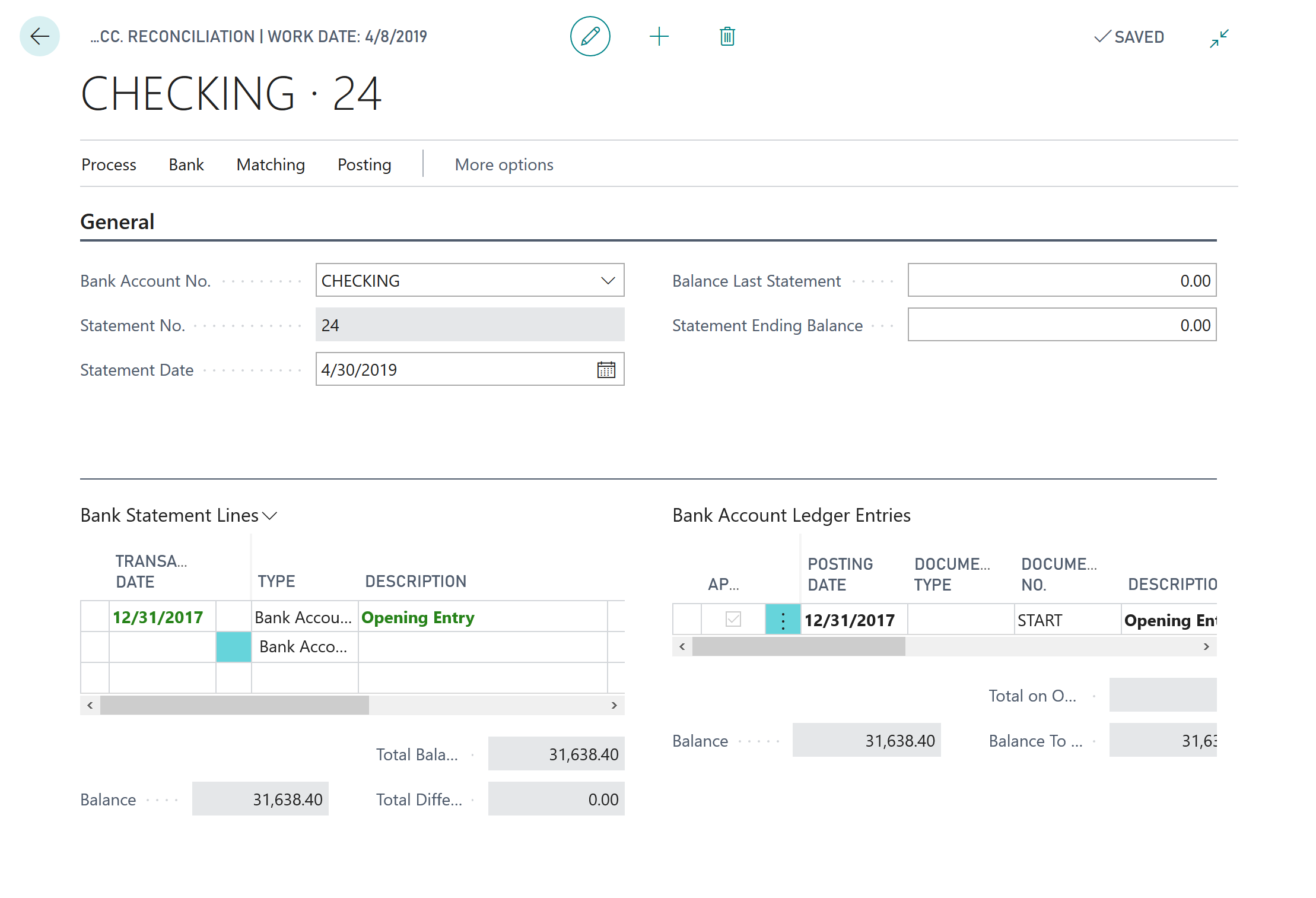

To reconcile bank accounts in Sparkrock ERP with statements that are received from the bank, you must fill in the lines on the Bank Acc. Reconciliation page.

You can use bank reconciliations to compare open bank account ledger entries with bank statement transactions.

When you run the reconciliation batch, for each open bank account ledger entry, a reconciliation line is created. If all the suggested reconciliation lines match the bank statement lines for the corresponding date range, you can post the reconciliation.

In a typical business situation, the following differences can occur:

Transactions that are entered in the bank account in Sparkrock ERP are not on the bank statement.

Transactions on the bank statement are not in Sparkrock ERP.

Transactions in the bank account and on the bank statement correspond to one another, but are recorded differently.

You must ensure that these differences are reconciled before you complete the reconciliation process.

To reconcile a bank account manually

Choose

, enter bank account reconciliations, and then choose the related link.

, enter bank account reconciliations, and then choose the related link.The Bank Account Reconciliations page opens.

On the action bar, choose Process > New.

The Bank Accounts page opens.

Select the bank account that you want to reconcile, and then choose OK.

The Bank Acc. Reconciliation page opens.

On the General FastTab, fill in the required fields as described in the following list:

- Bank Account No.: The bank account number to reconcile.

- Statement No.: The bank statement number to reconcile.

- Statement Date: The bank statement date.

- Statement Balance: The bank statement balance.

On the action bar, choose Process > Suggest Lines.

The Suggest Bank Acc. Recon. Lines page opens.

Specify a Starting Date and Ending Date, and then choose OK.

The Bank Statement Lines FastTab now displays the bank statement lines for the selected bank and period. By default, they are automatically applied with the open bank account ledger entries that are displayed in the Bank Account Ledger Entries FastTab.

Remove transactions that are not in the bank statement

Typically, the first step in reconciling differences is to remove the transactions that are specified in Sparkrock ERP that do not appear in the bank statement. Examples of these transactions are as follows:

Checks that are sent to the vendors, but are not presented to the bank.

Payments that are received and entered, but are not deposited and cleared in your bank account.

To remove entries

To select the entries that you want to remove, on the Bank Statement Lines FastTab, choose Show more options > Select More, and then select the respective lines.

To remove the entries, choose Delete Line.

When you perform these actions, Sparkrock ERP automatically removes the respective lines on the Bank Account Ledger Entries FastTab. The non-reconciled entries appear on the next reconciliation.

Add and post transactions that are recorded by the bank

After you remove transactions that do not appear on the bank statement, add the lines for bank-related transactions, such as fees or interest. Because these transactions are not in Sparkrock ERP, you must manually perform the following steps:

Add the transactions manually to the bank reconciliation lines.

Transfer the line to a general journal.

Post the transactions by using a general journal.

Apply the posted general journal entry to the bank reconciliation line.

To add a transaction

On the Bank Statement Lines FastTab, to insert a line, choose Show more options > New Line.

A new row appears.

In Transaction Date, specify the transaction date.

Ensure that the Type is set to Bank Account Ledger Entry.

In Description, specify a description of the transaction.

In Statement Amount, specify the amount of the transaction.

On the action bar, choose Process > Transfer to General Journal.

The Trans. Bank Rec. to Gen. Jnl. page opens.

Specify a value for Gen. Journal Template and Gen. Journal Batch, and then choose OK.

Sparkrock ERP creates a general journal line for the statement amount that you entered. Next, you have to select an account type and account number. The balancing account type is Bank Account with the number of the bank account that you're reconciling.

After you select an account type and number, if you post the general journal, Sparkrock ERP creates a bank account ledger entry that is automatically included in the bank reconciliation.

Record incorrect transaction amounts

If a bank statement contains an incorrect transaction, the following outcomes will occur:

The transaction cannot be applied to a ledger entry.

The bank reconciliation cannot be posted.

To resolve the incorrect bank statement line

On the Bank Acc. Reconciliation page, select the incorrect bank statement line.

In the Type field, specify Difference.

A dialog box appears.

To delete the application, choose Yes.

When you remove the application, the ledger entry is still open when the bank reconciliation is posted, similar to the usual outstanding deposit entries.

Reconciling line amounts with the amounts in the bank statement

If the Total Difference field is equal to the sum of all lines where the Type field is Difference, the bank reconciliation can be posted. However, the bank reconciliation cannot be posted until the amount for the reconciliation line is equal to the incorrect amount in the bank statement. You can correct this imbalance by using the following methods:

Adjust the statement amount to equal the amount on the bank statement.

Add a line for the difference between the two amounts.

To add a line for the difference between the two amounts

On the Bank Statement Lines FastTab, create a line.

In Transaction Date, specify the date of the transaction.

In Type, specify Difference.

In Description, specify a description of the transaction.

In Statement Amount, specify the amount of transaction.

With either method, there is still an open ledger entry that must be applied when the bank corrects the error. Typically, this task is performed during the next bank reconciliation.

When you record transaction differences with this method, the advantage is that the correct general ledger bank account balances are retained in Sparkrock ERP.

The disadvantage of using this method is that, as soon as the reconciliation is posted, users can't determine whether the differences are resolved or whether other errors in the bank statement are corrections of previous errors.

Next unit

Post the Bank Account Reconciliation

Feedback

To send feedback about this page, select the following link: